U.S. auto sales rose to an all-time record of 17.47 million units in calendar year 2015. Through the first 11 months of 2016, 15.85 million new cars, trucks, SUVs, crossovers, and vans had been sold in America.

U.S. Vehicle Sales Rankings By Model - 2016 Year End

December 2016 sales, however, were much stronger than anticipated. The forecasted 2% decline turned into a 3% year-over-year improvement, driving the calendar year's total up 0.3% to 17.5 million units, an all-time record performance for the industry.

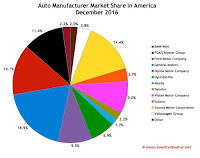

Despite a steady downturn in U.S. sales of passenger cars, America's four top-selling utility vehicles all reported record annual sales, pickup truck volume rose nearly 6%, and minivan volume grew by more than 6%. While General Motors, Ford Motor Company, Toyota Motor Corp. and Fiat Chrysler Automobiles – America's four top-selling manufacturers – all reported fewer sales in 2016 than in 2015, the gains produced by Honda, Mercedes-Benz, Nissan, Subaru, and Hyundai-Kia (all of which broke annual records) more than offset the losses by the biggest automakers.

|

| Click Chart To Expand |

If you don't wish to see automakers arranged alphabetically, click column headers to sort automakers by December sales, year-over-year change, year-to-date totals, or any other order. Best seller lists for cars, trucks, and SUVs will be added later this afternoon. In the coming days, GCBC will also publish a complete list of year end sales for every single vehicle line, a list which includes brand results. (Check out the 2015 version here.) You can always find historical monthly and yearly sales figures for any brand by clicking the brand name in the table below or by selecting a make (or model) at GCBC's Sales Stats page.

Click column headers to sort by specific categories. Using the mobile version of GoodCarBadCar? Thumb across the table for full-width visibility or switch to the web version at the bottom of the page, at which point columns will be sortable.

November 2016 • December 2015 • Updated at 4:57 PM AT on 01.04.2017

Rank | Automaker | Dec. 2016 | % Change | 2016 | % Change | Dec. 2016 Market Share | 2016 Market Share |

|---|---|---|---|---|---|---|---|

#22 | 17,148 | 1.9% | 161,360 | -8.9% | 1.0% | 0.9% | |

#36 | 52 | -7.1% | 516 | -21.7% | 0.0% | 0.0% | |

#18 | 23,195 | 13.7% | 210,213 | 4.0% | 1.4% | 1.2% | |

#35 | 407 | -29.9% | 2581 | -3.9% | 0.0% | 0.0% | |

#16 | 32,835 | -5.2% | 313,174 | -9.5% | 1.9% | 1.8% | |

#20 | 21,288 | 2.8% | 229,631 | 2.9% | 1.3% | 1.3% | |

#19 | 21,446 | 3.2% | 170,006 | -3.0% | 1.3% | 1.0% | |

#2 | 212,959 | 12.8% | 2,096,510 | -1.4% | 12.6% | 12.0% | |

#23 | 16,776 | -31.7% | 231,972 | -27.0% | 1.0% | 1.3% | |

#14 | 36,329 | -21.4% | 506,858 | -3.9% | 2.2% | 2.9% | |

#31 | 2606 | -53.6% | 32,742 | -23.7% | 0.2% | 0.2% | |

#1 | Ford | 224,994 | -0.8% | 2,487,487 | -0.6% | 13.3% | 14.2% |

#32 | 1733 | --- | 6948 | --- | 0.1% | 0.0% | |

#7 | 63,415 | 5.8% | 546,628 | -2.2% | 3.8% | 3.1% | |

#4 | 143,329 | 6.9% | 1,476,582 | 4.8% | 8.5% | 8.4% | |

#9 | 60,572 | -4.6% | 768,057 | 0.8% | 3.6% | 4.4% | |

#21 | 18,198 | 20.6% | 138,293 | 3.6% | 1.1% | 0.8% | |

#29 | 4294 | 259% | 31,243 | 116% | 0.3% | 0.2% | |

#6 | 83,159 | -6.4% | 926,376 | 6.1% | 4.9% | 5.3% | |

#10 | 54,353 | 0.2% | 647,598 | 3.5% | 3.2% | 3.7% | |

#26 | 8279 | -1.9% | 73,861 | 4.6% | 0.5% | 0.4% | |

#12 | 41,182 | -0.5% | 331,228 | -3.9% | 2.4% | 1.9% | |

#24 | 12,791 | 17.8% | 111,724 | 10.4% | 0.8% | 0.6% | |

#33 | 1694 | 58.5% | 12,534 | 7.2% | 0.1% | 0.1% | |

#17 | 28,754 | -1.8% | 297,773 | -6.7% | 1.7% | 1.7% | |

#15 | 35,871 | -6.2% | 374,541 | 0.4% | 2.1% | 2.1% | |

#28 | 4658 | -7.0% | 52,030 | -11.1% | 0.3% | 0.3% | |

#27 | 7383 | -6.4% | 96,267 | 1.0% | 0.4% | 0.5% | |

#5 | 134,545 | 8.3% | 1,426,130 | 5.5% | 8.0% | 8.1% | |

#30 | 4015 | 2.0% | 54,280 | 4.9% | 0.2% | 0.3% | |

#11 | 53,597 | 10.2% | 545,851 | 11.1% | 3.2% | 3.1% | |

#34 | 1186 | 77.3% | 6211 | -17.0% | 0.1% | 0.0% | |

#8 | 63,177 | 12.3% | 615,132 | 5.6% | 3.7% | 3.5% | |

#3.2 | Scion ° | 102 | -94.6% | 12,028 | -63.5% | 0.0% | 0.1% |

#3.1 | Toyota ° | 201,945 | 3.5% | 2,106,374 | -0.7% | 12.0% | 12.0% |

#3 | 202,047 | 2.6% | 2,118,402 | -1.7% | 12.0% | 12.1% | |

#13 | 37,229 | 20.3% | 322,948 | -7.6% | 2.2% | 1.8% | |

#25 | 10,129 | 8.4% | 82,724 | 18.1% | 0.6% | 0.5% | |

--- | --- | --- | --- | --- | --- | --- | --- |

319,108 | 10.0% | 3,042,775 | -1.3% | 18.9% | 17.3% | ||

243,229 | 2.0% | 2,449,630 | -2.0% | 14.4% | 14.0% | ||

237,785 | 0.1% | 2,599,211 | -0.1% | 14.1% | 14.8% | ||

192,519 | -10.0% | 2,244,315 | -0.4% | 11.4% | 12.8% | ||

160,477 | 6.4% | 1,637,942 | 3.2% | 9.5% | 9.3% | ||

152,743 | 9.7% | 1,564,423 | 5.4% | 9.0% | 8.9% | ||

116,658 | -0.9% | 1,422,603 | 2.5% | 6.9% | 8.1% | ||

64,846 | 16.1% | 590,022 | -2.7% | 3.8% | 3.4% | ||

37,493 | -5.4% | 365,204 | -9.7% | 2.2% | 2.1% | ||

| 37,057 | -4.8% | 380,752 | 0.1% | 2.2% | 2.2% | ||

12,573 | 30.5% | 105,104 | 23.6% | 0.7% | 0.6% | ||

--- | --- | --- | --- | --- | --- | --- | --- |

--- | Total | 1,688,368 | 3.0% | 17,539,052 | 0.3% | --- | --- |

Red font indicates declining year-over-year volume

* Does not include Lamborghini

^ Excluding Sprinter/Metris: down 6.4% to 32,011 in December; down 0.8% to 340,237 in 2016.

° Alfa Romeo, Chrysler, Dodge, Fiat, Jeep, Ram = FCA

WSJ estimate for Tesla: up 39.4% to 4600 in December; up 69% to 39,975 in 2016.

ANDC estimate for Tesla: up 4.4% to 2250 in December; up 5.4% to 26,725 YTD.

† Industry total takes into account Automotive News figures/estimates for brands such as Tesla and other low-volume, high-priced manufacturers.

RECOMMENDED READING

U.S. Auto Sales Brand Rankings - November 2016

U.S. Auto Sales Brand Rankings - 2015 Year End

U.S. Auto Sales Brand Rankings - December 2015

U.S. Auto Sales Brand Rankings - 2016 Year End

0 Komentar untuk "U.S. Auto Sales Brand Rankings - December 2016 & Year End"